Why Support SEA?

For over 50 years, SEA has offered exciting and challenging academic programs in ocean studies. Through a rare blend of theoretical learning and hands-on application, SEA’s multidisciplinary curriculum offers students a unique opportunity to explore the challenges facing our oceans. During SEA programs, students deepen their understanding of the impact of climate change and marine debris and the importance of biodiversity and coral reef conservation on the future of our environment.

SEA continues to expand our program offerings to meet the growing interests of a new generation of ocean scholars and stewards.

SEA depends upon the generosity of alumni, parents, and other donors to:

EXPLORE

Donation Form

WAys to Give

Annual Fund

Planned Giving

How to Give

Sea Education Association, like most educational institutions, depends upon annual giving to sustain its programs and to provide financial aid to students who otherwise could not participate in SEA’s undergraduate, high school, and gap year programs. To achieve long-term stability, SEA relies on an increasing number of loyal donors who give to the Annual Fund each year.

Our fiscal year begins on July 1 of each calendar year and runs until June 30 of the next year.

For electronic transfers, please contact development@sea.edu or (508) 444-1921 for instructions on how you can transfer the securities to our custodial bank.

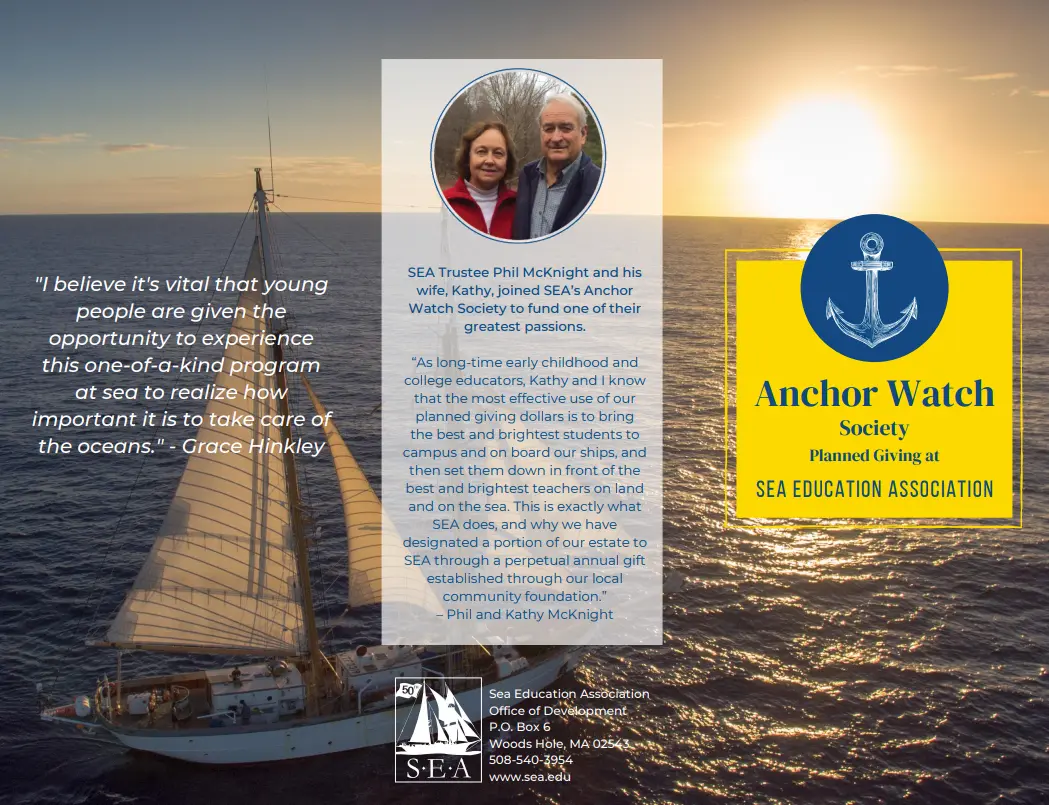

Planned giving offers numerous opportunities to support SEA in ways that might not be possible during your lifetime. By including a bequest in your estate, you can make a significant impact with gifts such as cash, appreciated securities, and real estate. This approach allows you to provide for your heirs while potentially reducing their tax burden. Plan for your future and contribute to the future of SEA through thoughtful, strategic giving. By making a planned gift, you will join SEA’s Anchor Watch Society, a special community of SEA parents, alumni and friends dedicated to ocean science and education, and to fostering future generations of ocean scholars, stewards and leaders.

Whether you’re a recent graduate of SEA, already established in your career, or retired, there are many ways to designate SEA as a future beneficiary of your estate:

Ways to Give

Gifts Through Your Will

An outright bequest will allow you to specify a gift of cash, securities, real estate, or tangible personal property. A residual bequest provides that, after specific bequests are made to named individuals, SEA receives the amount remaining in the estate. A contingent bequest means that SEA will receive certain assets only if a named individual does not survive you. A testamentary trust can provide income for life to another person or persons with the principal ultimately passing to SEA.

Another benefit of the unitrust is that you generally incur no capital gain on the transfer of appreciated assets to fund the trust.

Charitable Remainder Unitrusts

A charitable remainder unitrust allows you to make a substantial gift to us and yet continue to receive income from the assets contributed. With the unitrust, you receive a fixed percentage of the fair market value of the trust’s assets annually, as those assets are revalued annually. The fixed percentage paid out must be at least five percent. Upon the creation of the unitrust, you receive a substantial federal income-tax deduction based upon the age of the beneficiary(ies), the rate of return specified in the trust, and other factors. The older the beneficiary(ies), the higher the charitable deduction.

Charitable Lead Trusts

The creation of a charitable lead trust allows you to pass significant assets on to younger family members with little or no gift or estate tax payable. You transfer assets to a trustee who would then make annual payments to us for a specified number of years, after which time the assets remaining in the trust would go to individuals of your choice.

For individuals in high estate- and gift-tax brackets, this trust offers the opportunity to transfer substantial assets to younger generations, completely or significantly free of transfer taxes.

Gifts of Life Insurance

This can be done either by purchasing a new life insurance policy or by contributing a policy that you currently own. SEA can be designated as the beneficiary of the policy, while you retain the right to change the beneficiary at a later date, and otherwise retain ownership of the policy. In this instance, no current tax deduction is available to you since you would still be the owner of the policy. However, at the time of your death, your estate would receive a charitable deduction when the proceeds of the policy are paid to us. To receive a current income-tax deduction, you would need to designate us as both the owner and the beneficiary of the insurance policy. When such a gift is made, the deduction will be equal to the cash value of the policy at the time of the gift. Many donors decide to continue to pay the premiums on the policy after the gift is made, in which case the additional premium payments are tax deductible the following year.

Charitable Remainder Annuity Trusts

Annuity trusts are very similar to unitrusts except that, with an annuity trust, the life income beneficiary(ies) receive a fixed dollar amount annually rather than a fixed percentage of assets in the trust. This form of trust is appropriate for those who prefer a fixed annual income, unaffected by changes in the stock market, interest rates, and the like. As with the unitrust, the annuity trust provides a substantial federal income-tax charitable contribution deduction. Also, you generally incur no capital gain on the transfer of appreciated assets to fund the trust.

Sea Education Association makes it easy for you to donate in the way that works best for you by offering a variety of options:

- Give Online

- Recurring Gifts

- Send a Check

- Call With a Credit Card

- Make a Gift of Stock

- Make a Wire Transfer

SEA Donor Privacy Policy

Sea Education Association respects the privacy of its donors and has put in place a Donor Privacy Policy to honor your rights.

Sea Education Association collects and uses personal information such as: name, address, telephone number, and email address when a donor voluntarily provides it to us. This information is kept on file for IRS purposes and is also used in our development and communication activities.

Sea Education Association does NOT sell, trade, or share its donor list with any other organization. Sea Education Association never sends out mailings on behalf of other organizations.

Sea Education Association subscribes to the Donor Bill of Rights.

The Donor Bill of Rights

The Donor Bill of Rights was created by the American Association of Fund Raising Counsel (AAFRC), Association for Healthcare Philanthropy (AHP), the Association of Fundraising Professionals (AFP), and the Council for Advancement and Support of Education (CASE). It has been endorsed by numerous organizations.

Philanthropy is based on voluntary action for the common good. It is a tradition of giving and sharing that is primary to the quality of life. To ensure that philanthropy merits the respect and trust of the general public, and that donors and prospective donors can have full confidence in the nonprofit organizations and causes they are asked to support, we declare that all donors have these rights:

- To be informed of the organization’s mission, of the way the organization intends to use donated resources, and of its capacity to use donations effectively for their intended purposes.

- To be informed of the identity of those serving on the organization’s governing board, and to expect the board to exercise prudent judgment in its stewardship responsibilities.

- To have access to the organization’s most recent financial statements.

- To be assured their gifts will be used for the purposes for which they were given.

- To receive appropriate acknowledgement and recognition.

- To be assured that information about their donation is handled with respect and with confidentiality to the extent provided by law.

- To expect that all relationships with individuals representing organizations of interest to the donor will be professional in nature.

- To be informed whether those seeking donations are volunteers, employees of the organization or hired solicitors.

- To have the opportunity for their names to be deleted from mailing lists that an organization may intend to share.

- To feel free to ask questions when making a donation and to receive prompt, truthful and forthright answers.